Credit Coop Integrates Entendre to Automate Onchain Accounting with AI

Credit Coop is excited to announce our integration with Entendre, an enterprise-grade AI accounting and bookkeeping platform to automate all blockchain and digital asset activity. Together, we’re bringing advancements to private credit by simplifying the complexities of borrower and lender accounting, transforming the user experience for businesses and investors alike.

Streamlining Financial Operations with AI

Accounting for loans often involves tedious processes, including manual tracking, document exports, and navigating complex blockchain explorers like Etherscan. In the crypto space specifically, there is added complexity as data is distributed across onchain environments. Through our integration with Entendre, we’ve eliminated these hurdles, replacing manual workflows with an AI-powered solution that provides a seamless, user-friendly experience.

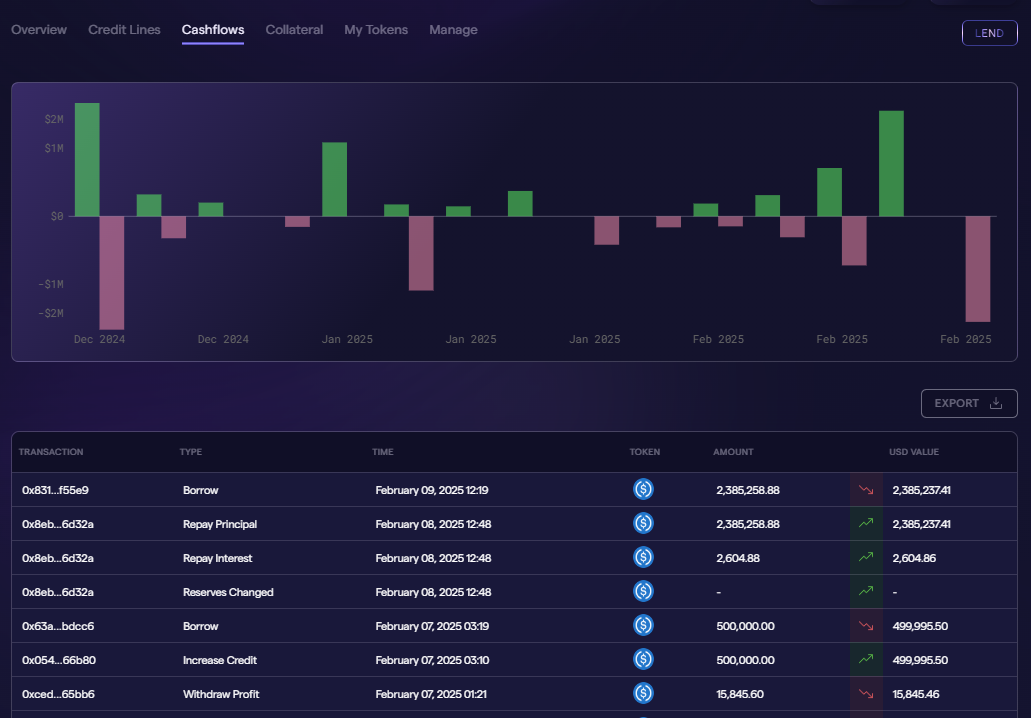

Entendre indexes our smart contract events, tracking key financial data like repayments, accrued interest, and borrowing activity. This data is then displayed in an intuitive dashboard, making it easy for borrowers to see their financial summaries at a glance and for lenders to understand their earnings.

Chris Walker, Co-Founder & CEO of Credit Coop, highlights: “I used to send Excel sheets to borrowers’ finance teams summarizing their onchain loan activity—a manual, time-consuming process. Now, borrowers and lenders can log in, view their data, and send it directly to their accountants. This improved user experience is a game-changer for how finance teams handle bookkeeping across both on- and off-chain transactions.”

Automating Real-Time Insights

Entendre’s AI technology ensures that all relevant transaction data is captured, processed, and displayed in real time. Borrowers no longer need to decipher blockchain logs or rely on intermediary reports. Instead, they can see exactly how much they’ve borrowed, repaid, and paid in interest – all within a clean, branded interface.

For lenders, the dashboard provides a complete overview of their lending activity, including total funds lent, repayments received, and yield earned. By removing the need for manual calculations and onchain data exploration, the integration saves time, reduces errors, and empowers users with actionable insights.

Building the Future of Private Credit

With nearly $30 million in credit deployed and zero defaults, Credit Coop’s securitization engine powers cryptonative private credit that originates and settles directly on blockchains. Through integrations like this one with Entendre, Credit Coop is building infrastructure for onchain credit markets, where credit is transparent, programmable, globally accessible 24/7/365, and backed by real business cash flows.

To learn more about the integration, visit the Entendre Help Centre. Or book a demo at https://entendre.finance/contact

Potential Borrowers: Ready to fuel your growth? Complete this form to discover how our Secured Line of Credit can propel your business forward.

Potential Lenders: Seeking yield? Complete this form to learn how our secured lending solutions generate real yield backed by real business cash flows.

About Entendre: Entendre is the first AI accounting platform for digital assets. Aggregating financial activity across all blockchains, wallets, exchanges and more. Entendre is trusted by the world's leading blockchain companies like Polygon, Celestia, and Rain to automate their accounting.

About Credit Coop: Credit Coop is transforming credit markets with blockchain-powered infrastructure that turns business cash flows into programmable collateral. Our platform delivers real-time settlement, automated loan servicing, and transparent credit monitoring, giving institutional lenders direct access to uncorrelated yield backed by verifiable cash flows. Credit Coop is building the foundation for a new generation of credit markets that are transparent, programmable, and settle 24/7/365.